I think, and I believe, (albeit some contestations) that investing is easy.

What’s tough is the thing that happens behind the curtain.

There are certain principles or as Charlie would say, “Latticework of mental models” that should in reality dictate how a person invests.

For example: Recently, Buffett bought stakes in few Japanese trading houses. Then, I started scuttle-butting, I wanted to know why did Buffett invested in Japanese businesses. And the finding blew me away.

Above is a screenshot of a book on Warren’s desk (Link: 1:58 min mark). So, Warren was reading this book in 2011-12 and any guesses when did he started buying stakes in the companies in Japan?

He for the first time started buying in 2020.

Now, this begs a lot of questions but one thing is very clear—He’s very patient with his money. And the question to ask is… Will you wait for 8-9 years to invest in a company?

If you can, then you’ve understood 95 percent of what investing really is.

Humans are very lazy but they want to make money very quickly. They don’t want to wait. But the wonder of compounding works only when it has been left to do its magic for a long time.

So, now we know there’s a need for patience in stock markets. Now, let’s look at how to do it.

How to be patient in stock markets?

A lot of how investing is done is related to timing—If you time it well enough, you can buy good companies at very cheap valuations (no strict maths) and good thing about valuation is that you’ll know when things are too cheap—Your gut will tell you that the company that you’re looking at is very cheap.

Example: Tata Motors in 2020—“Simple company”—manufactures automobiles—the stock was hammered because of possible decline in sales due to the pandemic. People thought TM is done. But, if you had stopped for a moment and asked—How much is the book value?—Tata Motors was selling around 0.35x its book value in March 2020—even if you believed auto sales would collapse, the company was selling for very cheap. But, the market was valuing company as it was going out of business. The valuation just by the visible numbers (no need for excel sheets) provided huge margin of safety.

I did buy it at that price and averaged-down my TM holding and I am up by about 450 percent.

No matter what, never, I repeat, never pay for high multiple companies—CDSL— awesome company—but, the PE is 60+ (as of 26 June, 2025), will I buy it? Not at these valuations. I’ll wait for something bad to happen before I buy the stock—And when I think yes, the price I’m paying is good, then I’ll buy it.

But, not at these sky-high valuations—There’s no margin of safety.

So, what do you do? You wait.

What to do while you are being patient?

If you can’t understand individual stocks—do a SIP in Flexi Cap fund and you’ll be fine.

But, if you can read about a ton of companies without getting bored then, read about a ton of companies, track them for an extended period of time before buying part of the business. As Buffett says, “Noah did not start building the ark when it was raining.”

Remember how Buffett started reading the book probably in 2012 and bought shares for the first time in 2020?

In between these two events, one of the prominent purchases of Buffett was buying a lot of Apple stocks in 2016—Buy when the time is right. This also highlights one more thing, for you to know whether something is of value, you’ll have to spend a lot of time understanding it, this is true for market as well as life.

I spend around 10-11 hours reading different books—trying to formulate my “latticework of mental models” and seeing whether any company matches that pre-requisite requirements or not.

You’ve to put in the work—there’s no shortcut to hard-work. Smart-work is BS. If you try to evade the hard work part of the process, you’ll eventually pay-up a lot in stock markets through costly mistakes. There’s no escape from putting every ounce of energy you have in the thing you would love to do. If you are trying to escape from it perhaps, you don’t love it enough.

So, while you are being patient—Do your homework, build your ark so that you can float when everything is under water.

What makes Buffett,“Buffett”?

Of like 100s of books written on Warren Buffett, “Snowball” is one of my favourite. But, it’s a lengthy book. So, after reading all the 826 pages you’ll reach at page 827 and there you will find the crux of the book and it says:

“The truth is this.

When Warren was a little boy fingerprinting nuns and collecting bottle caps, he had no knowledge of what he would someday become. Yet as he rode his bike through spring valley, flinging papers day after day, and raced through the halls of The Westchester, pulse pounding, trying to make his deliveries in time, if you had asked him if he wanted to be the richest man on earth—with his whole heart, he would have said, Yes.

(He was still putting in the effort—you might not work as hard as you would normally if you knew you would be a billionaire in the future.)

That passion led him to study a universe of thousands of stocks. It made him burrow into libraries and basements for records nobody else troubled to get. He sat up nights studying hundreds of thousands of numbers that would glaze anyone else’s eyes. He read every word of several newspapers each morning and sucked down the Wall Street Journal like his morning Pepsi, then Coke. He dropped in on companies, spending hours talking about barrels with the woman who ran an outpost of Greif Bros. Cooperage or auto insurance with Lorimer Davidson. He read magazines like the Progressive Grocer to learn how to stock a meat department. He stuffed the backseat of his car with Moody’s Manuals and ledgers on his honeymoon. He spent months reading old newspapers dating back a century to learn the cycles of business, the history of Wall Street, the history of capitalism, the history of modern corporation. He followed the world politics intensely and recognised how it affected business. He analysed economic statistics until he had a deep understanding of what they signified. Since childhood, he had read every biography he could find of people he admired, looking for the lessons he could learn from their lives. He attached himself to everyone who could help him and coattailed anyone he could find who was smart. He ruled out paying attention to almost anything but business—art, literature, science, travel, architecture—so that he could focus on his passion. He defined a circle of competence to avoid making mistakes. To limit risk he never used any significant amount of debt. He never stopped thinking about business: what made a good business, what made a bad business, how they competed, what made customers loyal to one versus another. He had an unusual way of turning problems around in his head (inversion), which gave him insights nobody else had.

(He was doing the “homework”.)

His passionate yearning to be rich gave him courage to ride his bicycle past the house with the awful dog and throw those last few newspapers in Spring Valley. It sent him to Columbia, seeking Ben Graham, after Harvard turned him down. It made him put one foot in front of the other, calling on people as prescriptionst, while they rejected him over and over. It gave him the strength to return to Dale Carnegie after losing his courage the first time. It lent him the dignity to face years of almost intolerable criticism without counterattacking during the Internet Bubble.”

These three paragraphs is all it takes to be “Warren Buffett” but, many still won’t do it. They won’t sit on chair for hours reading 100s of balance sheets. They won’t do everything possible to save every dollar/rupee they can. Most people will buy iPhones, Macs or something else from the money they make in stock markets (I did that!). No one will go around travelling with a book or Moody’s Manuals while on their honeymoon.

They won’t. They can’t. They are busy thinking what the world will think of them if they do it.

Everything that you see above is kinda like, the “sorting” feature on shopping apps that does the opposite of the shopping apps— you make money from it. Yet, 99.99% of the people reading this won’t do it—This is harsh but, true.

The Question Remains—Is Investing Easy?

In one word, yes, it’s easy if you do your homework, stick to your circle of competence and don’t take unnecessary risk.

As the duo often say: “Smart men go broke three ways: liquor, ladies and leverage.”

Don’t buy stocks because your friend says so. Don’t buy stocks just because it went up 200% in the last week.

You know what’s hard about investing?

The “homework” part. You’ll have to spend hours reading things that might bore you. You might have to print 50 individual 500 page annual letters so that you can sit and read. You might have no time to socialise, party, go out on trips, go on dates, any and many such things. But, if it were easy everyone would be doing it. Bezos says, generational things aren’t supposed to be easy, if they were, every Tom, Dick and Harry would be doing it.

You’ll have to read and re-read hundreds of books before you know you’ve figured out your style of investing. You’ll have to read books from very-very diverse subjects for example—one moment you’re reading “The Innovator’s Dilemma” and the next moment you are reading “Writer, Sailor, Soldier, Spy”, but the beautiful thing about readings is the it all adds up—Reading is like compounding of words and I think this is the kind of compounding that has the potential to give you 1000+ percent CAGR over your whole life.

I think, people who stopped reading died a long time ago. Not reading is death for the soul.

If you ask me, I think, “The Warren Buffett Way” and “What I Learned About Investing from Darwin” should be part of essential reading if you’re trying to understand how to look for companies, when to invest, and how to “sit on your ass” while compounding does its work.

Doing homework doesn’t make sure that you won’t be wrong. You’ll be wrong that’s inevitable part of investing or anything in general. Buffett for example, bought preferred shares of Solomon Brothers and within three years the treasury scandal came to fore. This was where during the proceedings Buffett said, “Lose money for the firm, and I will be understanding; lose a shred of reputation for the firm, and I will be ruthless.” Coming back to the point, the scandal and the shareholder’s wealth destruction that followed wasn’t Buffett’s fault.

The point here is—There are numerous variables in investing, try to minimise your ‘input variables’—try controlling your point of failures, do your best with what you control and one of the biggest factors that you control in investing is: What you are paying for the underlying business.

Never forget this.

You know, the other thing that’s hard about investing?

Human Behaviour

We are one f*ed-up breed of animals but, the best in that is the fact that we know that we’re f*ed-up. If you understand yourself well enough, you can work on your vices and read books such as “Algorithms to Live By”, “Invent and Wander”, “Poor Charlie’s Almanack”, read Daniel Kahneman’s work. Sit alone and understand your behaviour, retrospect where you went wrong the last time.

Why did you get angry last time, why did you react a certain way? Read about and ponder on your vices—This is the hard part about investing.

Be a Biography nut— So that you can see where people before you have gone nuts.

Read History—Understand the pattern of society.

Read Economics—Interpret them the way you would want to understand them.

Read Psychology—Understand how humans behave in pressure—during market meltdowns.

There’s no shortcut to doing the thing you love. If you equally love reading Biology, Physics, History, Psychology and many more subjects then, you’ll be a great investor—world is multi-disciplinary—you won’t excel in it if all you know is one subject or worse, one topic (PhD people).

This quote by Richard Feynman is on my wall: “Study hard what interests you the most undisciplined, irreverent, and original manner possible.”

If you’re not interested in things beyond one subject, you’ll fail—in life and in investing.

Sorry, it’s harsh but, true.

Another thing that’s hard about investing—Compounding

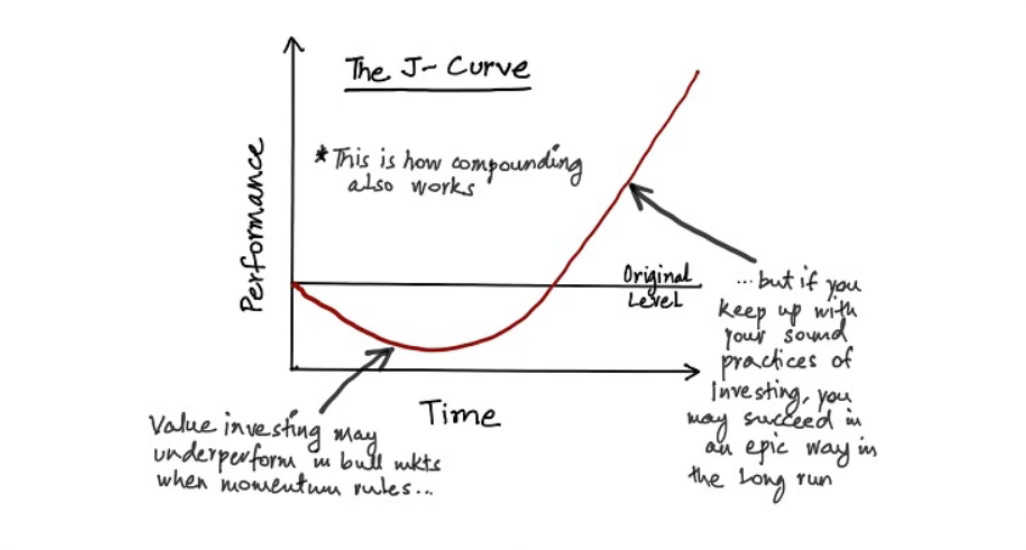

It takes an awful long time for compounding to work. The J-Curve below visualises it well. The slowness of compounding has the capacity to make you cry.

So, what to do about it? Keep at it. If you’ve done your homework, have invested well within you understanding of the “margin of safety” and you don’t need the money for the long run, keep at it. As Buffett says, “You can't produce a baby in one month by getting nine women pregnant”.

Somethings just take time and that’s compounding for you.

So, now the answer to the question: Is investing Easy?

It’s easy, if you know what you’re doing.

It’s easy, if you did your homework.

It’s easy, if no-one knows more about the company you’re investing in than you.

It’s easy, if you like to read 8-9 hours a day.

It’s easy, if you like shifting through 100s of balance sheets a month.

It’s easy, if don’t like people and you would rather spend that time learning from the eminent dead.

It’s easy, if you like sleeping with books on your bed.

It’s easy, if you’ve sacrificed a certain part of life for something that you love to do.

It’s easy, if you’re okay with not using your “smartphone” for more than an hour—daily screen time.

It’s easy, if it takes a lot of effort for people to reach out to you. (Be hard to reach.)

It’s easy, if you don’t give-up when things get tough.

It’s easy, if you love knowledge that results from hard-work.

It’s easy, if you can ignore the noise of social media.

It’s easy, if you’re comfortable being uncomfortable.

It’s easy, if you love making hard decisions.

It’s easy, if you love doing every second of it and you won’t stop it even if someone pays you to stop it—Think Steve Jobs—How much money would you have offered him so, that he doesn’t work at Apple anymore?—I’m sure, even if you had offered him a billion USD he would still have wanted to work at Apple.

So, do the thing you’d love to do for free then, do it for money. It’ll be easy.

Thanks for reading, Love Ya!

P.S: Whatever I write will always be free. That is, if I am not under any contractual obligations.

So, subscribe.

Very well written with a lot of truths…

Nice reading