India is the world’s 3rd largest car market after China and the United States. It surpassed Japan’s auto-sales in 2023 and is projected to be one of the fastest growing market in the world. But, the EV penetration in the country is quite low at around 2.5 percent of the total cars sold in India in 2024.

India aims to be a leader in EV mobility solution as it needs EVs to achieve its 2060 climate goals. So, the Indian government has come up various plans to support the manufacturing, sale, and construction of new battery charging infrastructure throughout the country.

Few reasons why I think that will be crucial in making India among the fastest growing EV market in the world—cities like Delhi, Mumbai and Bengaluru will incentivise sale of electric vehicles due to the need of reducing pollution1 and also there is a need for early adopters to buy more EVs so that later on the market can allow for cheaper version of cars. Also, the central government has set an ambitious target of EVs to make upto 30 percent of all the vehicle sales by FY2030, supported by various plans offering subsidies, financing options, and loans pertaining to infrastructure development.

Automobile manufacturers across various price points have expressed their interest in making India one of their main markets, Tesla has been in talks with the central as well as various state governments to possibly set-up “gigafactories” to start manufacturing vehicles primarily for the Indian market but also automobiles that can be exported to South East Asia, Africa, Middle-East and Central and South America.

On the other hand, companies such as Suzuki sees India as their global manufacturing hub and they want to fully leverage the opportunities in India to export vehicles to Europe, Japan, Middle-East, Africa, Central and South America.

Twenty to thirty years down the line, electric mobility will be as pervasive as Internal Combustion Engine (ICE) cars are today as more and more companies invest in it, it has the potential to revolutionise the 4-wheeler car market.

Industry Overview

The Indian passenger car market was valued at US$ 32.70 billion in 2021 and is expected to reach a value of US$ 54.84 billion by year 2027. While the Global EV market is estimated at approximately US$ 250 billion in 2021 and is projected to grow to US$ 1,318 billion by 2028.

India for the first time sold 100,000 EVs in FY24 compared to about 82,600 EVs in 2023. As the need for infrastructure grows, the EV related infra development will necessitate investment of around US$ 180 billion in vehicle manufacturing and charging infrastructure.

This will provide three fold investment opportunities: new vehicle manufacturing plants; charging infrastructure related investment and battery manufacturing plants.

Industry Growth Prospects

Indian automotive industry is expected to grow at about 6 to 8 percent CAGR between 2024 and 2029, the growth figures are such is due to the burgeoning middle class and increased disposable income. At the same time, Indian auto component market is expected to grow at a CAGR of about 16 percent to reach $200 billion by 2030. Indian ride-sharing market is expected to grow at a CAGR of 56 percent between 2024 and 2030.

Indian 4 W electric market is also expected to grow, for example, Tata Motors expects its EV contribution to reach about 25 percent by 2027 and reach 50 percent by 2030. In December 2023, Tata Passenger Electric Mobility Ltd (TPEM) and Bharat Petroleum Corporation Limited (BPCL) signed an MoU to establish 7000 public charging stations nationwide to enhance customer satisfaction. These kinds of partnerships will be common going forward. India needs a lot of investment in charging infrastructure and many of existing ‘fuel pumps’ won’t be able to accommodate the charging infrastructure thus, necessitating investments in new land and charging points.

The conventional Internal Combustion Engine (ICE) car manufacturing companies will be investing a lot of resources going forward in this sector. In the next 10-years car companies are planning to invest around ₹2-trillion focusing mainly on EVs. This doesn’t account the investments that will be made by pure EV companies such as Tesla and BYD.

Companies

In India there are few major players in the EV automobile sector, the market is led by Tata Motors (62%), followed by MG Motor India (22%) and other significant players in the market include Mahindra & Mahindra (7%), BYD (2.85%), PCA-Citroen (2.19%).

Tata Motors

Tata Motors is the dominant player in the market with a market share of 62 percent in 2024. But, as the total addressable market (TAM) and competition grows, you can still expect Tata Motors to maintain its primacy in the market due to reasons discussed below.

Tata Motors offers its EV from 8 Lakh to about 26 Lakh and most of the new launches happening in the EV markets are beyond 20 lakhs. Tata Motor’s first moving advantage allows it to maintain the market leadership in the sub 15 lakh range. Main competition in this segment is MG’s Comet and maybe in 3-5 years we can see competitive cars from Maruti Suzuki but, that’ll take some time. Tata Motors has the first mover’s advantage in the Indian 4-Wheeler EV market. Tata Motors has proven its lead over other OEMs; according to Tata Motors—“More than 200,000 EVs have commutatively crossed 5 billion kilometres and more than 10,000 EVs have done more than 100,000 kilometres”. Tata Motors’ over 18,000 EV charging station in partnership with Tata Power is a plus and an advantage that will be a unique selling point for the customers.

To fulfil the demand, Tata Motors will be launching at least three new models (Harrier EV, Sierra EV, Avinya) and facelifts of at least four models (Altroz EV, Punch EV, Tiago EV, Tigor EV). And going forward, Tata Motors will be a notable company to keep notice of.

MG Motor India

Morris Garages (MG) entered India with the partnership JSW (35%), IndoEdge India Fund (8%), Dealers trust (3%), SAIC Motors of China owns 49%, and the rest is owned by employees of the company in the form of ESOP. In this configuration, Indian entities commutatively own 51 percent share of the company. Going forward, JSW group plans to own 51 percent of the company, increasing stake at regular intervals.

MG Motor began their commercial operations in 2019 with the acquisition of General Motors’ Hanoi plant in Gujarat, paying $50 million to the American automaker. MG Motors plans to list the entity in few years.

Over the last few years, MG has sold more than 200,000 cars in the Indian market making them one of the fastest growing automobile companies in India. In 2023, MG achieved retail sales of around 56,902 units in which EVs accounted for 25 percent of the sales, amounting to 14,225 units.

MG’s focus on EVs is increasing evident by the Feb 2025 numbers, as 78% of the units sold by MG were EVs. As of May 2025, MG offers three EV models in the Indian market: the Comet EV, ZS EV, and Windsor EV, with prices ranging from ₹4.99 lakh to ₹13.10 lakh. With plans to launch, Cyberster, M9 EV, and iM L6, in coming months.

Mahindra & Mahindra (M&M)

Mahindra’s journey in the EV segment started with the acquisition of majority stake in Reva Electric Car company in 2010. They launched their first EV in 2012 by the name of e2o but, it was hindered by high costs, lack of charging infrastructure and limited range. In 2016, Mahindra launched two e-Verito models addressing two markets: Personal Vehicles and Commercial Vehicle (CV). These vehicles had limited success and they were used in very limited capacity, mainly adopted by fleet operators and government entities.

The next push for Mahindra came in 2018 with the establishment of Mahindra Electronic Technology Centre with the focus on R&D related to EVs. Mahindra invested more than ₹3000+ crores in the facility. This culminated in Mahindra launching the “Born EV”2 platform with an objective to launch EVs for the Indian market signalling a major shift in the EV strategy.

Mahindra has also partnered with Volkswagen group for supply of MEB platform components. (Motors, Batteries, etc.) The British International Investment group have also invested around ₹2000 crores in the EV subsidiary of M&M.

As of May 2025, M&M have launched two “Born EVs”—BE 6 and XEV 9e. The deliveries started in Feb and as of May they have delivered over 6500 units of these models.

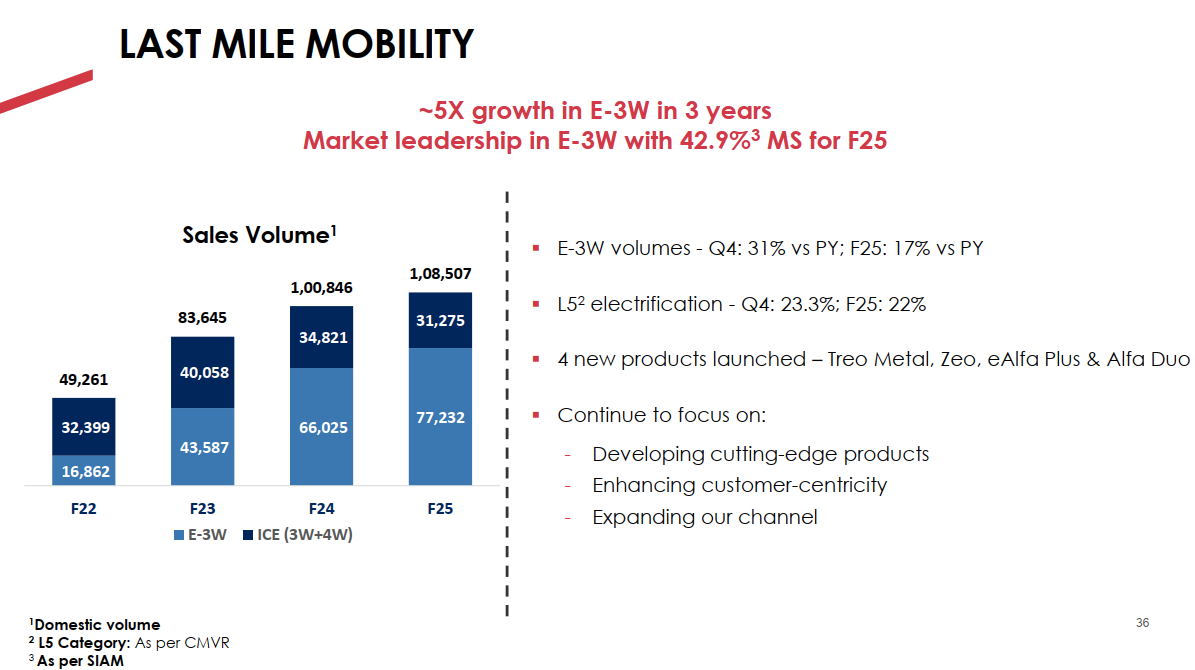

Mahindra is a leader in “Last Mile Mobility” solutions. In the last 4 years, Mahindra has sold more than 200,000 units. As of April 2025, Mahindra Last Mile Mobility Limited (MLMML) holds 37.3% share in the L 5 category3.

Hyundai and Maruti Suzuki

Hyundai as of May 2025 offers only two models of EVs in India— Creta Electric (₹17.99 Lakh and top model price goes upto ₹24.38 Lakh) and Ionic (starts at ₹46.05 Lakh). They do have plans to launch three more EV products after the Creta EV. Hyundai plans to own about 20 percent of EV market by 2030. Hyundai India Chief Operating Officer Tarun Garg expects EV volumes to double in the next two years.

Maruti Suzuki hasn’t launched any EVs in India as of May 2025. Mainly because the customer that they serve is not ready to pay the premium that is required to pay for an EV. Recently, they also revised their 2030 EV plans due to these factors and competition is expected to grow with all major OEMs entering the market with their Mass-market models and focusing on improving infrastructure. One part of Maruti Suzuki’s plan is to make India a manufacturing hub for EVs that they export to Europe, Japan and other south-east Asian countries. The other approach that Maruti Suzuki has adopted is offering models across multiple fuel types— Hybrid, CNG and flex-fuel. Maruti Suzuki expects CNG to be the largest contributor in the powertrain mix by FY31. India is already one of the largest production bases for Internal combustion engine-based cars, and a key exporter to markets in Middle-East and Africa.

BYD and Tesla

When comparing these two companies, we see that BYD is already in India and Tesla is planning to enter India by the end of FY 25.

BYD offers at least four models in India-SEALION 7, eMAX7, ATTO 3, and SEAL and they also have plans to offer more models to India in the coming months. BYD in the FY24 sold about 3500 cars in India. The biggest challenge BYD faces in Indian market is the Indian government, in 2023, the government blocked BYD’s partnership with Megha Engineering and Infrastructure limited (MEIL). Recently, Commerce minister Mr. Piyush Goyal commented "India has to be cautious about its strategic interests, who we allow to invest” when asked about BYD’s prospects in India.

Looking at the market as a whole, BYD will be a bigger challenge to traditional Players like TATA and Mahindra than Tesla and even Maruti Suzuki and others. BYD offers cutting edge technology at a fraction of the cost and the only thing that has the potential to limit BYD’s growth is the geopolitical relations India shares with China.

For Tesla, India is a big opportunity market with lots of potential. As BYD has left it behind in China and its sales are slowing in Europe and America due to the political backlash faced by Elon due to his comments on elections in Britain and Germany and his increasing affiliation with Donald Trump. For Tesla, India as the 3rd largest automobile market in the world that is growing at an average rate of about 7 to 8 per cent per year presents a worthy opportunity. India’s automobile market is worth about $150 billion and is expected to cross $300 billion by 2030.

India is a price sensitive market and Tesla might have to price it’s vehicles accordingly. It might have to release vehicles that are market specific with respect to India, south-east Asia and Middle-eastern markets. In India it’ll be a volume game, for example— Tata’s Tiago is priced at about $14,000 and Tesla’s least expensive car, the Model 3 starts at about $39,000. According to WSJ, only about 6554 cars were sold in India that were above this price point.

Consumers

In the last 5-6 years, Indian consumers have become more asking towards the vehicle’s safety standards and safety rating. And one of the prime reason for Tata’s success in the last few years is the safety standard Tata adheres to in the manufacturing process of its vehicles. As highlighted by the survey about 62 percent of the Consumers are list product quality and safety as the most important while choosing a car. This number is higher than markets such as Germany and Japan where pricing becomes a leading factor.

According to ‘Deloitte's 2025 Global Automotive Consumer Study’ about 54 percent of the consumers want to buy vehicles that cost between 10 lakhs and 25 lakhs with 27 percent in the lower half and 27 percent in the upper half. Another aspect that will be changing is the traditional showroom model of vehicle sale, as about 76 percent of the consumers are ready to buy their next vehicle directly from the manufacture-led sales channel in reshaping consumer behaviour.

In Indian market due to factors such as urban convenience and financial considerations 70 percent consumers between the age of 18-34 are open to Mobility-as-a-service solution4.

Indian automotive market is poised for growth and the OEMs which can focus on quality of their vehicles has most potential for success in the long run and with EVs coming into the mix, how brands position themselves will lead to OEM controlling a substantial share of the market. As the penetration of charging infrastructure grows in the country, it will tackle the “range anxiety” and other limiting factors while purchasing an EV.

Supply Chain

With EVs, automotive industry is gearing up for once-in-a-century disruption that will bring substantial changes to the way OEMs used to manufacture ICE (definitely not Donald Trump’s ICE) vehicles. With substantial growth that the industry is poised to, the question— whether to produce in-house or buy from other suppliers will be a substantial one.

The Indian government wants 80 percent electrification for two-wheelers and three-wheelers by 20305. With more companies participating in this “rush” the end goal to produce the vehicle with utmost efficiency will be a crucial one because the survivability of these OEMs hinges on these factors. Vertical supply chain integration allows the OEMs to tackle any challenges emerging from economic, geopolitical and other reasons.

Another aspect of EVs, which was not that big of a concern for traditional ICEs are software related technology. It’s not just infotainment and other secondary aspects but, the most crucial ones— security, self-driving tech, changing, parking assist, etc. In future, one way to differentiate products would be the software in cars, Tesla today “recalls” vehicles through software updates which earlier used to be a visit to the dealerships or service centres.

Today, majority of the EV related supply chain is China based and as countries try to hedge the geopolitical risk associated with concentrated supply chain, companies will try to diversify according to the needs of the market. For example— Tesla might source its battery from CATL in china but, partners with Tata or others to procure batteries for EVs manufactured in India.

We most probably will see these kinds of deals. We might also see EV manufacturers buying startups or established but smaller players.

Regulatory Environment

The regulatory environment in India pertaining to EVs are dynamic to say the least. On one hand, India welcomes investment on the other it restricts investments as well (case in point: BYD). India in the last two years has changed its policies regarding EV imports with a caveat— Companies that are getting deductions on their import bills are supposed to invest $500 million in local manufacturing within three years. While at the same time providing subsidies and incentives to manufacturers so that they can start producing EVs and build related supply chain in India.

One of the most crucial policies of the government related to EVs is PM E-DRIVE scheme6. It replaced the Fame-II and Electric Mobility and Promotion Scheme. This scheme has a total outlay of ₹10,900 crore over a two-year period. Under this scheme, the government allocated ₹3,679 crore in subsidies to support adoption of e-2Ws, e-3Ws, e-ambulance, e-trucks and other emerging EVs. It also allocates ₹500 crore for the deployment of e-Ambulances. The scheme also has provisions of ₹4,391 crore for the procurement of 14,028 e buses by State Transport Undertaking/public transport agencies. It also provides for 22,100 fast chargers for e-4 Ws, 1800 fast chargers for e-buses and 48,400 fast chargers for e-2W/3Ws.

The Indian Government recently also reduced its custom duty on imported EVs with minimum CIF value of $35,000, provided the manufacturers invest at least $500 million in local manufacturing in three years. These provisions are contingent on the conditions that the companies must achieve 25 percent Domestic Value Addition (DVA) within three years and 50 percent within five years.

The government has also reduced the GST on EVs and charging stations to 5 percent and allows for income tax deduction upto ₹1.5 lakh on interest paid for EV loans under section 80EEB.

There are various other state government incentives to promote EV adoption as well. For example— Delhi Government aims 95 percent of new vehicle registration to be EVs. It also plans to install 13,200 new EV charging stations, ensuring one every 5 kilometres. The Government of Uttar Pradesh is offering similar benefits and has plans to invest in charging infrastructure as well. Majority of the states have some policy concerning EVs and most of them are working on increasing the feasibility of their states’ infrastructure for EVs.

Conclusion

Indian automotive market is poised for an upheaval due to the technological efficacy, governmental policy needs and changing consumer behaviour. The question is, who will ride this wave in the best manner possible. Or everyone will surf the wave but no one will make money as it has been the case with automobile businesses in the past.

The sector will see considerable increase of investments in EV manufacturers, component manufacturers, as well as power generation companies. But, the thing is—I’m not the only one to know this. Everyone knows this. So, when do you buy in such situations were the prices are as high as the clouds? You research everything there is to research and then go all in when there is an opportunity. The best hedge against this uncertainty of the industry is to buy when there is panic in the market—Think Tata Motors in 2020-it was selling quite low.

P.S: I’ve tried to cover very small ‘cog in the wheel’ of overall EV market. I think, I’ll have to write few more articles to cover various other aspects such as auto ancillaries, individual company analysis, power companies and a lot more factors needs to be studied before making any investments.

Thanks for reading, do subscribe it you think it has been informative.

Love ya!

Future Ideas for articles:

What went wrong with Japanese EV dream?

— Came across this really informative article by Gregory Brew and Michael E. Webber on Barron’s.

Does the Economics of EVs make sense?

Does the Environmental claims of EVs make sense?

Company analysis in the EV sector—OEMs, Component Manufactures, Power generation companies, etc.

Albeit ‘EV reducing pollution’ can be subject of a detail article by itself which I’ll be covering soon.

Born EVs are essentially vehicles that were developed as EV— Meaning, there are no ICE version of these models.

In the Indian automotive context, L5 refers to a three-wheeled motor vehicle category. Specifically, it's a vehicle with a maximum speed exceeding 25 kmph and either an engine capacity exceeding 25 cc (if it's a thermic engine) or motor power exceeding 0.25 kW (if it's an electric motor).

Think—Uber, Ola, Lyft.

The Indian government aims to significantly increase the proportion of electric vehicles (EVs) in its transportation sector, aiming for 30% penetration in private cars, 70% in commercial vehicles, 40% in buses, and 80% in two and three-wheelers by 2030.

PM E-DRIVE: Prime Minister Electric Drive Revolution in Innovative Vehicle Enhancement.